Investment Update.

-compiled by Darragh Hogan

After a strong 2021, it has been a bit of a difficult period in the markets this year. Investors are exhibiting uncertainty as Central banks continue to move interest rates higher. The market downturn, which commenced in the first quarter of 2022, intensified through April; global equities and bonds are both down mid-single digits since the end of March.

Expectations of aggressive Central bank policy to fight inflation, global growth concerns and the ongoing war in Ukraine all weighed on investor sentiment in the markets. Inflation readings have hit new highs; interest rate expectations are rising and bond yields have been sky rocketing.

The war in Ukraine has intensified in the country’s southern and eastern regions and foreign countries have proposed new sanctions against Russia. The impact of this on global energy markets remains high as Europe struggles to find substitutes for its Russian energy supplies. The impact of the conflict in Ukraine is beginning to come through in economic data. While labour markets remain robust and unemployment rates fell across the Eurozone, consumer sentiment measures have continued to weaken.

In Asia, rolling lockdowns in China since the beginning of the year presents headwinds to Chinese and global growth at a time when growth is already under pressure. China’s 5.5% growth target for 2022 is now looking unlikely.

Outlook for the Year Ahead

The outlook for equity markets over the next 12 months is dependent on several factors, including Central bank policy, growth, inflation and the evolution of the Russia-Ukraine crisis. While the outlook suggests there may not be much growth in the short term, it remains positive over the medium to long term (a five to 10-year view).

As Susan has previously mentioned in her updates, the old adage, “it’s not about timing the market, but about time in the market,” has been proven true over the years. Research shows that those who stay invested over the long run in a well-diversified portfolio will generally do better than those who try to profit from turning points in the market.

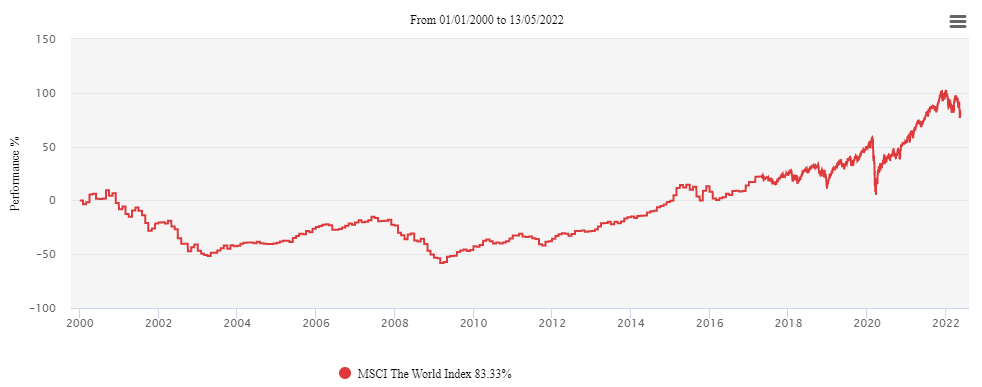

MSCI World Index – A Snapshot

The snapshot of performance from the MSCI World Index (January 2000 to date) shows the unpredictability of the market and is expected to continue to fluctuate on a daily basis. However, we need to take a medium to long-term view. While falls in the market can naturally be concerning, it’s important to bear in mind that investment or price volatility is usually associated with investment risk; and short-term volatility is the price an investor must pay for the potential of higher long term returns.

As financial services consultants, we base our investment advice on the long-term fundamentals rather than short-term market noise. If you have any concerns or queries in relation to your portfolio, we are happy to set up a review should you require. We will review your individual goals/risk profile, as well as the time frame for your financial plan and work with you to build towards a better outcome.

If you have concerns about the current state of your protection cover or are concerned about your future, talk to your financial adviser today. There are no crystal balls, but ensuring you have a plan is a step in the right direction towards financial stability.

Here to help you navigate your way to financial security.

For further information please contact Darragh Hogan via email or phone: (01) 406 8020.

Milestone Advisory DAC t/a Milestone Advisory is regulated by the Central Bank of Ireland.

Warning: The value of your investment may go down as well as up.

If you are concerned about the performance of your fund or investment, you should contact your financial adviser.