Post Retirement Management.

Manage your assets wisely to ensure you enjoy retirement and never run out of money

Retirement today is simply another of life’s transitions. This is when you change from a phase of working and building wealth to a phase of relaxation and spending the money you saved over the years. We are living longer thanks to advancements in technology and healthcare, but as a result, our retirement savings may need to last for 30 years or more. This requires prudent management of your financial resources to ensure that you never run out of money, especially in retirement.

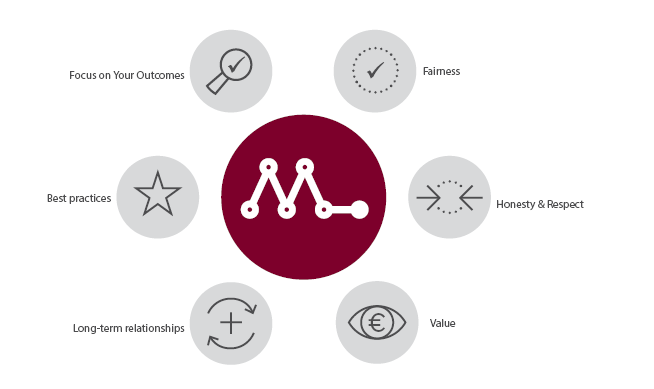

At retirement, you will need help assessing your financial objectives and understand what the most suitable options available to you are. We have developed a “Post-Retirement” service tailored to your specific requirements and provides a risk profile which is individual to you. We then implement the agreed strategy in line with your future financial requirements and your attitude and ability to bear investment risk.

There are a number of steps involved in this process, which includes:

There are a number of steps involved in this process, which includes:

- Objective Setting: We help you define your retirement goals and understand your preferred income structure.

- Post-retirement assets: We work with you to identify all your post-retirement assets, to gain an understanding of your overall financial position. This would include pension assets such as current pension fund, deferred fund, other assets and State Pension entitlements.

- Risk Profile: We provide a full explanation of the relationship between ‘risk’ and ‘reward’ when discussing investments. It will also cover a risk assessment, so we can understand your appetite for risk, should there be an investment element.

- Market Jargon: Every industry has it’s own version of complicated jargon and regulatory language. We provide a full and transparent explanation, ensuring you are clear and confident moving forward with any advice or recommendations.

- Investment Strategy: We combine all the information you have provided (assets and risk appetite), to create a strategy that meets your retirement objectives within your risk profile.

- Product Solution: We research and negotiate the best terms on your chosen product, ensuring you are getting the best value for money. We will help you complete relevant paperwork and liaise with the provider on your behalf, ensuring all the documentation is finalised and in order.

- Future Reviews: Once you are set for your future, it’s important to ensure you remain on course. We provide future reviews to ensure your retirement objectives remain on track and any changes in your requirements are worked into your future plans.

If you would like to learn more about our post-retirement planning service, our team of financial services consultants would be happy to help. To get started on your post-retirement journey, contact us for an initial call.