Income Tax

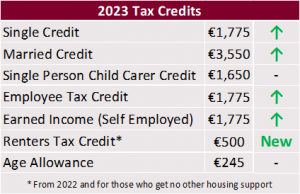

- The standard rate income tax band for a single person for 2023 will be increased by €3,200 to €40,000, with corresponding increases for married couples, and the main tax credits by €75.

- A new €500 tax credit is being introduced from 2022 for those paying rent for their principal private residence who are not receiving any other State housing support.

USC

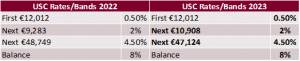

- The 2% USC band will be increased in 2023 from €9,283 to €10,908 with the 4.5% band reduced from €48,749 to €47,124.

- USC does not apply to State Pensions.

- Exemptions from USC applies where total income (excluding the State Pension) in 2023 is less than €13,000.

- Self employed additional 3% USC surcharge on non PAYE incomes over €100,000 continues to apply for 2023.

- A 2% USC rate for those over 70 and medical card holders for total income (excluding the State Pension) in excess of €12,012 and under €60,000 continues to apply for 2023.

PRSI

- No change in PRSI rates and bands. If you are aged 66 or over, you do not have to pay PRSI on your income.

Pensions

- No change in pension tax relief, the €2m Standard Fund Threshold limit or the €115,000 maximum amount of earnings taken into account for calculating tax relief on pension contributions.

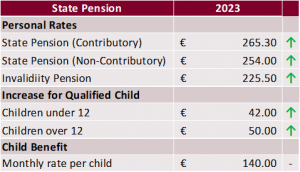

- State pension (Contributory) €12 per week increase to €265.30 per week.

- Also announced last week that:

- State Pension Age to be maintained at 66.

- Option from January 2024 to work until 70 in return for a higher state pension.

- PRSI rates to be reviewed every 5 years – to be confirmed when first review will happen.

Protection, Savings & Investments

- No change in the insurance levies (Government Levy 1%, Personal Investor Exit Tax 41%). Review to consider the taxation of funds, life assurance policies and other investments announced.

- Please note pensions and post retirement ARFs are not subject to tax on the growth of the fund.

- No change in the taxation treatment of death benefits payable from protection plans.

- No change in Capital Gains Tax (33% for Personal Investors).

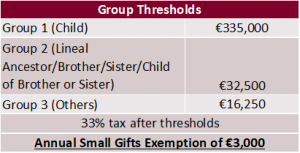

- No change in Capital Acquisitions Tax (CAT). Please contact me should you require more details regarding the annual small gifts exemption. The below thresholds apply to all gifts and inheritances received since 5 December 1991.

- No change in DIRT (currently 33% – reduced in stages from 41% in 2016.

Other Items of Interest

- The Help to Buy scheme for first time buyers extended to end of 2024 at current rates and terms.

A Vacant Home Tax is being introduced at 3 times the Local Property Tax. - Once off electricity credit for all households totalling €600 to be paid in three instalments; the first payment will be made before Christmas.

- Double week Social Welfare payment in October and 100% Christmas bonus will be paid in December. You can read more information on Social Welfare Benefits here.

- Employers can provide benefits up to an increased total value of €1,000 (previously €500) tax free.

Please note that it is possible that other taxation changes not announced in the Budget and not outlined above could be introduced in the Finance Bill 2022 when it is published around the end of October.

You can read more details about the 2023 Budget here.

Here to help you navigate your way to financial security.

Careful planning before retirement can help minimise or even avoid some of the knock-on effects that taxes can create. This can be complex but will enable you to reap the well-earned rewards. For further information, get in touch with me via phone (01 406 8020) or email (darragh@milestoneadvisory.ie).

Careful planning before retirement can help minimise or even avoid some of the knock-on effects that taxes can create. This can be complex but will enable you to reap the well-earned rewards. For further information, get in touch with me via phone (01 406 8020) or email (darragh@milestoneadvisory.ie).

Milestone Advisory DAC t/a Milestone Advisory is regulated by the Central Bank of Ireland.

Warning: The value of your investment may go down as well as up.