Life Cover is an important yet often overlooked feature of good financial planning…

To decide if it is something you need, you simply have to ask; how would your family cope financially if you, as either the main or joint income earner, died?

If you read this column regularly, you’ll know we’ve covered the importance of Income Protection, Pensions, and even the importance of a well-diversified investment portfolio. Now I’m writing about the importance of Life Cover, which is really going back to basics.

You may have overlooked a Life Cover policy because you have Mortgage Protection. This would cover the cost of your mortgage if you were to die, however, your income pays for many other things for you and your family, and it is important that they are covered too.

Life Cover Options

There are a few different types or Life Cover, but essentially, Life Cover is an insurance policy that pays out a lump sum in the event of your death. As previously mentioned, you will often have a certain amount of life cover attaching to your mortgage, called mortgage protection. This will ensure that you do not leave someone with the burden of your mortgage on your death.

Other types, (whole of life or term insurance) will pay the lump sum of money to your dependants on your death. The idea is that this will alleviate the financial burden in your absence. Things to consider include the cost of your funeral expenses, any debts you have incurred such as your credit card or car loans, college fees, along with all and any day to day expenses that you, as an income earner provide for your family.

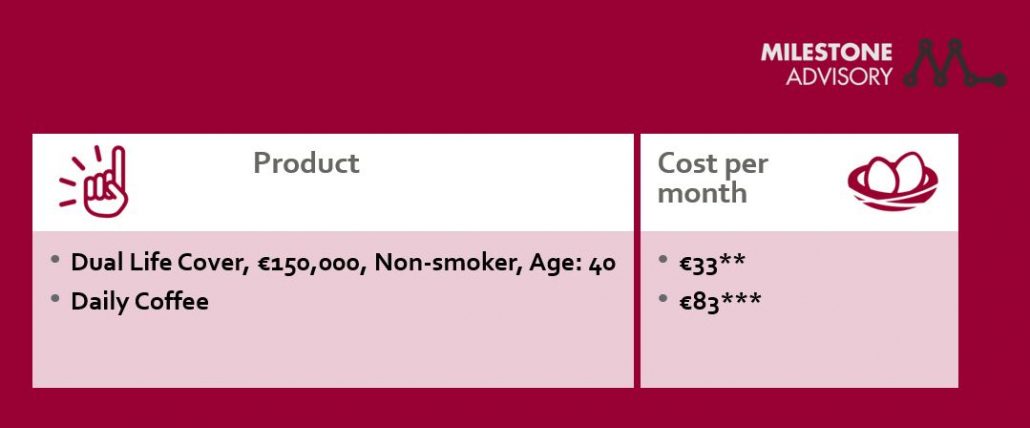

It may seem like there are many more important financial matters things to consider, and there is no way to afford cover for every scenario, but consider these costs outlined in the table below:

**this is an approximate figure based on a quote of all Irish Life Assurers at June 2015

***this assumes a cost per cup of coffee of €2.75 per day

It’s interesting to think of the things that we consider too expensive and then those that we can find a way to afford!

Your financial adviser will be able to help you choose the right level of cover in each category that suits you (and your families) needs best and it is a conversation you should have sooner rather than later. We don’t expect to die young and leave our families with in a financial quandary, but it happens, and as with most types of insurance, hopefully we never need to claim it – but it’s nice to know it’s there.

Here to help you navigate your way to financial security.

The Milestone Advisory team are qualified financial services consultants. We specialise in helping professionals in the construction sector and related industries. Our team will work with you to review your finances, explaining your options in clear English.

No jargon – just the facts.

For further information please contact Susan O’Mara via email or phone: (01) 406 8020. Milestone Advisory DAC t/a Milestone Advisory is regulated by the Central Bank of Ireland.