Ship Shape

In trying to compile my annual top tips for the coming year, I researched far and wide for pearls of wisdom that I might not have already thought of myself….this was my favourite: “Get Your Finances-and Body-in Shape”.

One study showed that more exercise leads to higher pay because you tend to be more productive after you’ve worked up a sweat. So taking up running may help amp up your financial game. Plus, all the habits and discipline associated with, say, running marathons are also associated with managing your money well.

I couldn’t find the corresponding “one” study; however, if it turns out that by the end of 2017 you aren’t better off financially, at least you will be fitter! Nothing to lose!

What will YOUR retirement cost?

On a more serious note however, in looking back over 2016, the majority of clients I met throughout the year (both young & older) hadn’t ever really crunched the numbers on the cost of their own retirement. And with this in mind, this is my only tip for 2017. If you do nothing else with your personal finances in 2017, do try to consider the actual cost of your own retirement. The internet is very useful for this, if your own pension provider doesn’t already have a pension calculator then there are many online.

But most people I spoke to didn’t visit them. If you are mid-way through your working life you ought to know how much you need to have saved or have yet to save for your retirement. If you are still in the beginning phase, understanding that starting earlier will take the pressure off down the road will help you and be a helpful motivator.

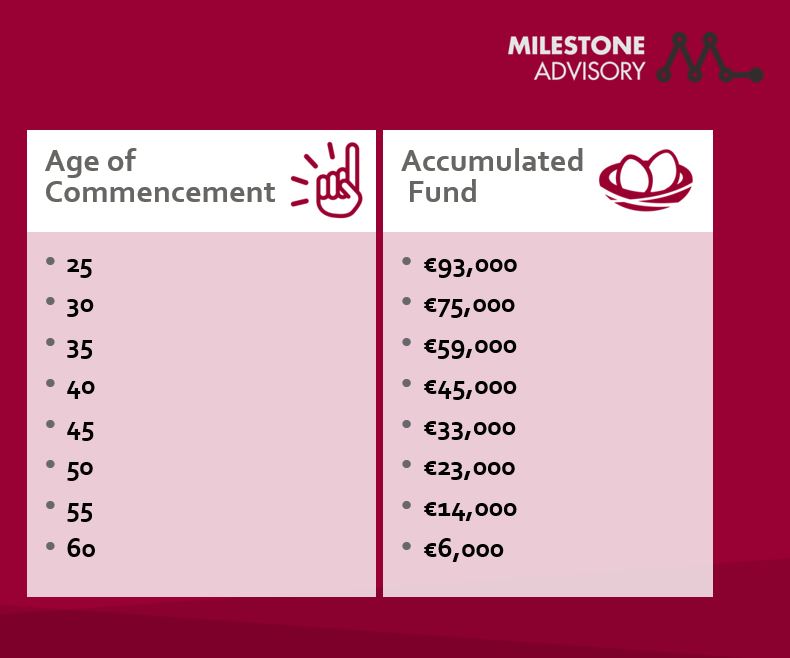

You can see from the table below the value of saving a monthly amount of €100 will accumulate a much greater fund at age 65 if you start at age 25 compared to starting at age 35 – That is €34,000 to be precise – The monthly premium over the same period (25 – 35) is only €12,000 more over the same 10 years – which means that starting at age 25 instead of waiting until age 35 has a net gain of €22,000. This is due to the 10 years more of extra investment growth*.

*for the purposes of this estimate is 3.09% per annum.

If you have been diligently contributing to a pension scheme all along, use the pension calculator to estimate the value of your current fund as retirement income. What income are you on track for?

How does it measure up against your current lifestyle and retirement goals?

If there is a gap, the sooner you know the sooner you can remedy it. Overall for 2017, the important thing to know is how much you’ve saved and how much you still need to. So, go on. Dig out that benefit statement from your pension provider and crunch the numbers!

Here to help you navigate your way to financial security.

The Milestone Advisory team are qualified financial services consultants. We specialise in helping professionals in the construction sector and related industries. Our team will work with you to review your finances, explaining your options in clear English.

No jargon – just the facts.

For further information please contact Susan O’Mara via email or phone: (01) 406 8020. Milestone Advisory DAC t/a Milestone Advisory is regulated by the Central Bank of Ireland.